| << Chapter < Page | Chapter >> Page > |

Before you get started, take this readiness quiz.

Sales tax and commissions are applications of percent in our everyday lives. To solve these applications, we will follow the same strategy we used in the section on decimal operations. We show it again here for easy reference.

Remember that whatever the application, once we write the sentence with the given information (Step 2), we can translate it to a percent equation and then solve it.

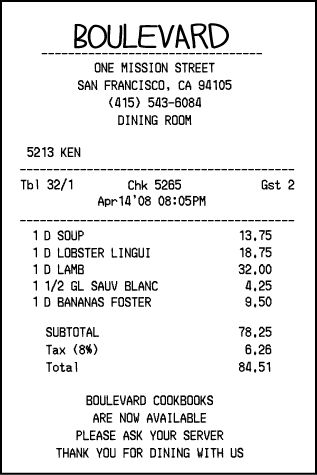

Do you pay a tax when you shop in your city or state? In many parts of the United States, sales tax is added to the purchase price of an item. See [link] . The sales tax is determined by computing a percent of the purchase price.

To find the sales tax multiply the purchase price by the sales tax rate. Remember to convert the sales tax rate from a percent to a decimal number. Once the sales tax is calculated, it is added to the purchase price. The result is the total cost—this is what the customer pays.

The sales tax is a percent of the purchase price.

Cathy bought a bicycle in Washington, where the sales tax rate was of the purchase price. What was

| ⓐ | |

| Identify what you are asked to find. Let number. | What is the sales tax? |

| Choose a variable to represent it. | Let sales tax. |

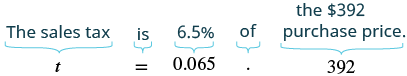

| Write a sentence that gives the information to find it. | The sales tax is 6.5% of the purchase price. |

| Translate into an equation. (Remember to change the percent to a decimal). |

|

| Simplify. |

|

| Check: Is this answer reasonable? | |

| Yes, because the sales tax amount is less than 10% of the purchase price. | |

| Write a complete sentence that answers the question. | The sales tax is $25.48. |

| ⓑ | |

| Identify what you are asked to find. Let number. | What is the total cost of the bicycle? |

| Choose a variable to represent it. | Let total cost of bicycle. |

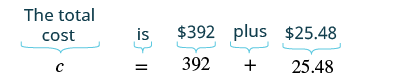

| Write a sentence that gives the information to find it. | The total cost is the purchase price plus the sales tax. |

| Translate into an equation. |

|

| Simplify. |

|

| Check: Is this answer reasonable? | |

| Yes, because the total cost is a little more than the purchase price. | |

| Write a complete sentence that answers the question. | The sales tax is $26.46 and the total cost is the price plus the sales tax or $392 + $25.48 = $417.48. |

Notification Switch

Would you like to follow the 'Prealgebra' conversation and receive update notifications?