| << Chapter < Page | Chapter >> Page > |

Supply-siders, on the other hand, prefer

regressive tax systems, which lower the overall rate as individuals make more money. This does not automatically mean the wealthy pay less than the poor, simply that the percentage of their income they pay in taxes will be lower. Consider, for example, the use of

excise taxes on specific goods or services as a source of revenue.

Another example of a regressive tax paid by most U.S. workers is the payroll tax that funds Social Security. While workers contribute 7.65 percent of their income to pay for Social Security and their employers pay a matching amount, in 2015, the payroll tax was applied to only the first $118,500 of income. Individuals who earned more than that, or who made money from other sources like investments, saw their overall tax rate fall as their income increased.

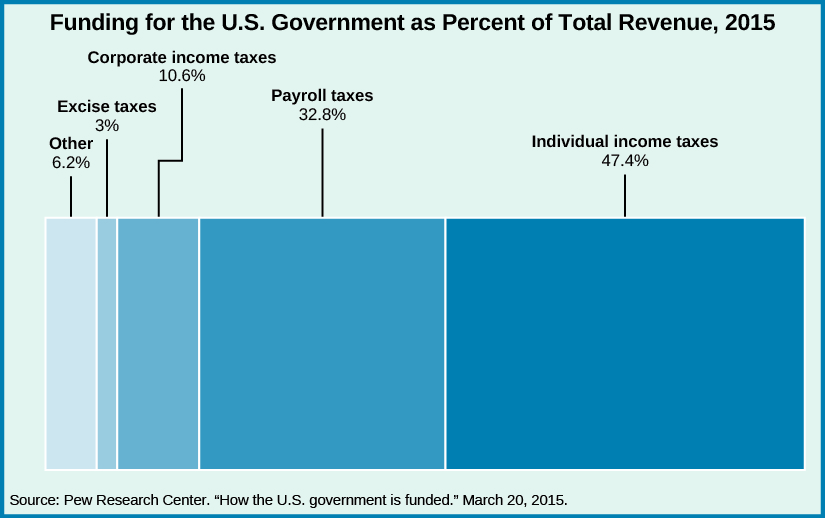

In 2015, the United States raised about $3.2 trillion in revenue. Income taxes ($1.54 trillion), payroll taxes on Social Security and Medicare ($1.07 trillion), and excise taxes ($98 billion) make up three of the largest sources of revenue for the federal government. When combined with corporate income taxes ($344 billion), these four tax streams make up about 95 percent of total government revenue. The balance of revenue is split nearly evenly between revenues from the Federal Reserve and a mix of revenues from import tariffs, estate and gift taxes, and various fees or fines paid to the government ( [link] ).

Financial panics arise when too many people, worried about the solvency of their investments, try to withdraw their money at the same time. Such panics plagued U.S. banks until 1913 (

[link] ), when Congress enacted the

Federal Reserve Act . The act established the Federal Reserve System, also known as the Fed, as the central bank of the United States. The Fed’s three original goals to promote were maximum employment, stable prices, and moderate long-term interest rates.

Notification Switch

Would you like to follow the 'American government' conversation and receive update notifications?