| << Chapter < Page | Chapter >> Page > |

The Brazilian central bank could weaken its exchange rate in two ways. One approach is to use an expansionary monetary policy that leads to lower interest rates. In foreign exchange markets, the lower interest rates will reduce demand and increase supply of the real and lead to depreciation. This technique is not often used because lowering interest rates to weaken the currency may be in conflict with the country’s monetary policy goals. Alternatively, Brazil’s central bank could trade directly in the foreign exchange market. The central bank can expand the money supply by creating reals, use the reals to purchase foreign currencies, and avoid selling any of its own currency. In this way, it can fill the gap between quantity demanded and quantity supplied of its currency.

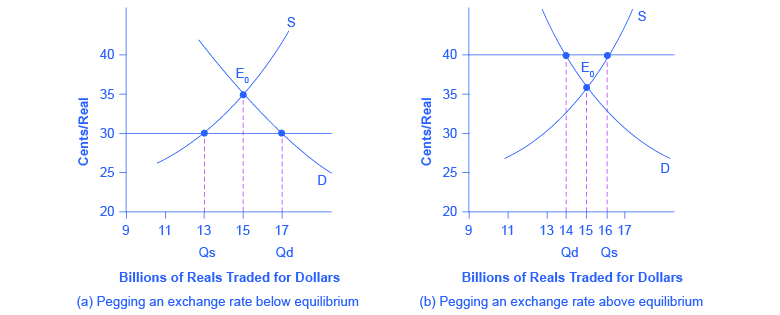

[link] (b) shows the opposite situation. Here, the Brazilian government desires a stronger exchange rate of 40 cents/real than the market rate of 35 cents/real. Perhaps Brazil desires the stronger currency to reduce aggregate demand and to fight inflation, or perhaps Brazil believes that that current market exchange rate is temporarily lower than the long-term rate. Whatever the reason, at the higher desired exchange rate, the quantity supplied of 16 billion reals exceeds the quantity demanded of 14 billion reals.

Brazil’s central bank can use a contractionary monetary policy to raise interest rates, which will increase demand and reduce supply of the currency on foreign exchange markets, and lead to an appreciation. Alternatively, Brazil’s central bank can trade directly in the foreign exchange market. In this case, with an excess supply of its own currency in foreign exchange markets, the central bank must use reserves of foreign currency, like U.S. dollars, to demand its own currency and thus cause an appreciation of its exchange rate.

Both a soft peg and a hard peg policy require that the central bank intervene in the foreign exchange market. However, a hard peg policy attempts to preserve a fixed exchange rate at all times. A soft peg policy typically allows the exchange rate to move up and down by relatively small amounts in the short run of several months or a year, and to move by larger amounts over time, but seeks to avoid extreme short-term fluctuations.

When a country decides to alter the market exchange rate, it faces a number of tradeoffs. If it uses monetary policy to alter the exchange rate, it then cannot at the same time use monetary policy to address issues of inflation or recession. If it uses direct purchases and sales of foreign currencies in exchange rates, then it must face the issue of how it will handle its reserves of foreign currency. Finally, a pegged exchange rate can even create additional movements of the exchange rate; for example, even the possibility of government intervention in exchange rate markets will lead to rumors about whether and when the government will intervene, and dealers in the foreign exchange market will react to those rumors. Let’s consider these issues in turn.

Notification Switch

Would you like to follow the 'University of houston downtown: macroeconomics' conversation and receive update notifications?