| << Chapter < Page | Chapter >> Page > |

A variety of studies by economists have found that the original inventor receives one-third to one-half of the total economic benefits from innovations, while other businesses and new product users receive the rest.

Will private firms in a market economy under invest in research and technology? If a firm builds a factory or buys a piece of equipment, the firm receives all the economic benefits that result from the investments. However, when a firm invests in new technology, the private benefits , or profits, that the firm receives are only a portion of the overall social benefits. The social benefits of an innovation take into account the value of all the positive externalities of the new idea or product, whether enjoyed by other companies or society as a whole, as well as the private benefits received by the firm that developed the new technology. As you learned in Environmental Protection and Negative Externalities , positive externalities are beneficial spillovers to a third party, or parties.

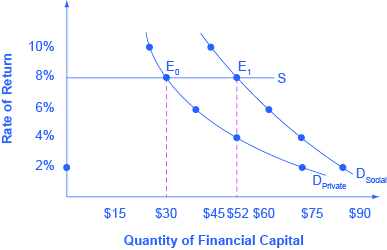

Consider the example of the Big Drug Company, which is planning its R&D budget for the next year. Economists and scientists working for Big Drug have compiled a list of potential research and development projects and estimated rates of return. (The rate of return is the estimated payoff from the project.) [link] shows how the calculations work. The downward-sloping D Private curve represents the firm’s demand for financial capital and reflects the company’s willingness to borrow to finance research and development projects at various interest rates. Suppose that this firm’s investment in research and development creates a spillover benefit to other firms and households. After all, new innovations often spark other creative endeavors that society also values. If we add the spillover benefits society enjoys to the firm’s private demand for financial capital, we can draw D Social that lies above D Private .

If there was a way for the firm to fully monopolize those social benefits by somehow making them unavailable to the rest of us, the firm’s private demand curve would be the same as society’s demand curve. According to [link] and [link] , if the going rate of interest on borrowing is 8%, and the company can receive the private benefits of innovation only, then the company would finance $30 million. Society, at the same rate of 8%, would find it optimal to have $52 million of borrowing. Unless there is a way for the company to fully enjoy the total benefits, then it will borrow less than the socially optimal level of $52 million.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?