| << Chapter < Page | Chapter >> Page > |

To see how these improvements have increased productivity and output at the national level, we should examine evidence from the United States. The United States experienced significant growth in the twentieth century due to phenomenal changes in infrastructure, equipment, and technological improvements in physical capital and human capital. The population more than tripled in the twentieth century, from 76 million in 1900 to over 300 million in 2012. The human capital of modern workers is far higher today because the education and skills of workers have risen dramatically. In 1900, only about one-eighth of the U.S. population had completed high school and just one person in 40 had completed a four-year college degree. By 2010, more than 87% of Americans had a high school degree and over 29% had a four-year college degree as well. In 2014, 40% of working-age Americans had a four-year college degree. The average amount of physical capital per worker has grown dramatically. The technology available to modern workers is extraordinarily better than a century ago: cars, airplanes, electrical machinery, smartphones, computers, chemical and biological advances, materials science, health care—the list of technological advances could run on and on. More workers, higher skill levels, larger amounts of physical capital per worker, and amazingly better technology, and potential GDP for the U.S. economy has clearly increased a great deal since 1900.

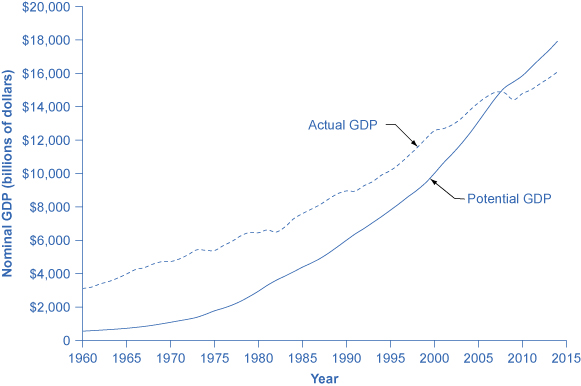

This growth has fallen below its potential GDP and, at times, has exceeded its potential. For example from 2008 to 2009, the U.S. economy tumbled into recession and remains below its potential. At other times, like in the late 1990s, the economy ran at potential GDP—or even slightly ahead. [link] shows the actual data for the increase in nominal GDP since 1960. The slightly smoother line shows the potential GDP since 1960 as estimated by the nonpartisan Congressional Budget Office. Most economic recessions and upswings are times when the economy is 1–3% below or above potential GDP in a given year. Clearly, short-run fluctuations around potential GDP do exist, but over the long run, the upward trend of potential GDP determines the size of the economy.

In the aggregate demand/aggregate supply model, potential GDP is shown as a vertical line. Neoclassical economists who focus on potential GDP as the primary determinant of real GDP argue that the long-run aggregate supply curve is located at potential GDP—that is, the long-run aggregate supply curve is a vertical line drawn at the level of potential GDP, as shown in [link] . A vertical LRAS curve means that the level of aggregate supply (or potential GDP) will determine the real GDP of the economy, regardless of the level of aggregate demand . Over time, increases in the quantity and quality of physical capital, increases in human capital, and technological advancements shift potential GDP and the vertical LRAS curve gradually to the right. This gradual increase in an economy's potential GDP is often described as a nation's long-term economic growth.

Notification Switch

Would you like to follow the 'University of houston downtown: macroeconomics' conversation and receive update notifications?