| << Chapter < Page | Chapter >> Page > |

This description of the short-run shift from E 0 to E 1 and the long-run shift from E 1 to E 2 is a step-by-step way of making a simple point: the economy cannot sustain production above its potential GDP in the long run. An economy may produce above its level of potential GDP in the short run, under pressure from a surge in aggregate demand. Over the long run, however, that surge in aggregate demand ends up as an increase in the price level, not as a rise in output.

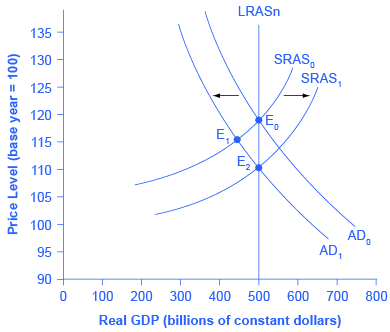

The rebound of the economy back to potential GDP also works in response to a shift to the left in aggregate demand. [link] again starts with two aggregate supply curves, with SRAS 0 showing the original upward sloping short-run Keynesian AS curve and LRASn showing the vertical long-run neoclassical aggregate supply curve. A decrease in aggregate demand—for example, because of a decline in consumer confidence that leads to less consumption and more saving—causes the original aggregate demand curve AD 0 to shift back to AD 1 . The shift from the original equilibrium (E 0 ) to the new equilibrium (E 1 ) results in a decline in output. The economy is now below full employment and there is a surplus of labor. As output falls below potential GDP, unemployment rises. While a lower price level (i.e., deflation) is rare in the United States, it does happen from time to time during very weak periods of economic activity. For practical purposes, we might consider a lower price level in the AD–AS model as indicative of disinflation, which is a decline in the rate of inflation. Thus, the long-run aggregate supply curve LRASn, which is vertical at the level of potential GDP, ultimately determines the real GDP of this economy.

Again, from the neoclassical perspective, this short-run scenario is only the beginning of the chain of events. The higher level of unemployment means more workers looking for jobs. As a result, employers can hold down on pay increases—or perhaps even replace some of their higher-paid workers with unemployed people willing to accept a lower wage. As wages stagnate or fall, this decline in the price of a key input means that the short-run Keynesian aggregate supply curve shifts to the right from its original (SRAS 0 to SRAS 1 ). The overall impact in the long run, as the macroeconomic equilibrium shifts from E 0 to E 1 to E 2 , is that the level of output returns to potential GDP, where it started. There is, however, downward pressure on the price level. Thus, in the neoclassical view, changes in aggregate demand can have a short-run impact on output and on unemployment—but only a short-run impact. In the long run, when wages and prices are flexible, potential GDP and aggregate supply determine the size of real GDP.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?