| << Chapter < Page | Chapter >> Page > |

By the end of this section, you will be able to:

A corporate merger occurs when two formerly separate firms combine to become a single firm. When one firm purchases another, it is called an acquisition . An acquisition may not look just like a merger, since the newly purchased firm may continue to be operated under its former company name. Mergers can also be lateral, where two firms of similar sizes combine to become one. However, both mergers and acquisitions lead to two formerly separate firms being under common ownership, and so they are commonly grouped together.

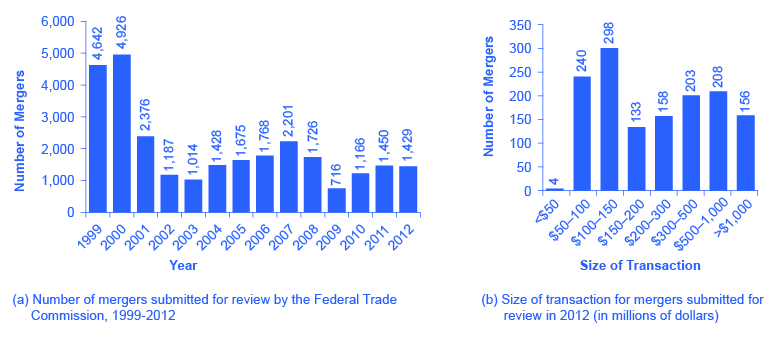

Since a merger combines two firms into one, it can reduce the extent of competition between firms. Therefore, when two U.S. firms announce a merger or acquisition where at least one of the firms is above a minimum size of sales (a threshold that moves up gradually over time, and was at $70.9 million in 2013), or certain other conditions are met, they are required under law to notify the U.S. Federal Trade Commission (FTC). The left-hand panel of [link] (a) shows the number of mergers submitted for review to the FTC each year from 1999 to 2012. Mergers were very high in the late 1990s, diminished in the early 2000s, and then rebounded somewhat in a cyclical fashion. The right-hand panel of [link] (b) shows the distribution of those mergers submitted for review in 2012 as measured by the size of the transaction. It is important to remember that this total leaves out many small mergers under $50 million, which only need to be reported in certain limited circumstances. About a quarter of all reported merger and acquisition transactions in 2012 exceeded $500 million, while about 11 percent exceeded $1 billion. In 2014, the FTC took action against mergers likely to stifle competition in markets worth 18.6 billion in sales.

The laws that give government the power to block certain mergers, and even in some cases to break up large firms into smaller ones, are called antitrust laws . Before a large merger happens, the antitrust regulators at the FTC and the U.S. Department of Justice can allow the merger, prohibit it, or allow it if certain conditions are met. One common condition is that the merger will be allowed if the firm agrees to sell off certain parts. For example, in 2006, Johnson&Johnson bought the Pfizer’s “consumer health” division, which included well-known brands like Listerine mouthwash and Sudafed cold medicine. As a condition of allowing the merger, Johnson&Johnson was required to sell off six brands to other firms, including Zantac® heartburn relief medication, Cortizone anti-itch cream, and Balmex diaper rash medication, to preserve a greater degree of competition in these markets.

Notification Switch

Would you like to follow the 'Principles of economics' conversation and receive update notifications?