| << Chapter < Page | Chapter >> Page > |

section 2: ledger accounts

ACTIVITY1:

To do ledger entries

[LO 3.3]

An account is a separate record in which all transactions for a particular item are entered.

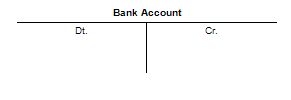

An account takes the form of a T and comprises three sections, namely:

Debiting an account means to do an entry on the debit side. Crediting an account means to do an entry on the credit side.

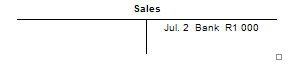

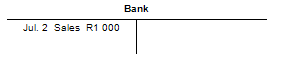

Every transaction affects at least two accounts. The one account is debited and the other account is credited. This is known as the double-entry system . In the details column of the ledger account the name of the other account involved in the transaction appears, for example:

This means that cash sales to the value of R1 000 were made. The two accounts are therefore bank and sales. The double entry will be as follows:

The following rules must be taken into account in the case of entries in ledger accounts:

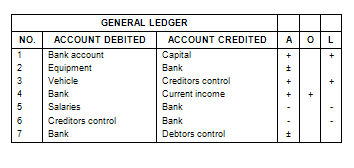

ASSIGNMENT 1:

1. Owner deposits some of his personal funds as capital in the bank account of the business.

2. Equipment is purchased and paid by cheque.

3. A vehicle is purchased on credit.

4. Cash is received for services provided.

5. Salaries are paid by cheque.

6. The amounts owed to creditors are paid.

7. Money is received from debtors.

Table for assignment 1

| GENERAL LEDGER | |||||

| NO. | ACCOUNT DEBITED | ACCOUNT CREDITED | A | O | L |

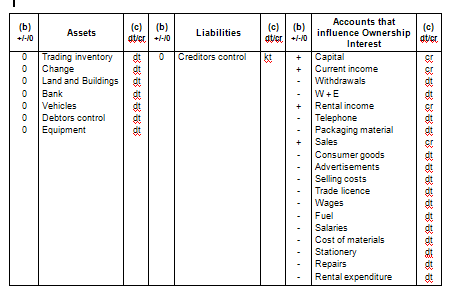

ASSIGNMENT 2:

| Current income | Consumer goods | Fuel |

| Withdrawals | Change | Salaries |

| Water and Electricity | Land and Buildings | Debitors control |

| Rental income | Advertisements | Equipment |

| Telephone | Selling costs | Cost of materials |

| Trading inventory | Trade licence | Stationery |

| Packaging material | Wages | Repairs |

| Sales | Bank | Rental expenditure |

| Vehicles | Creditors control | Capital |

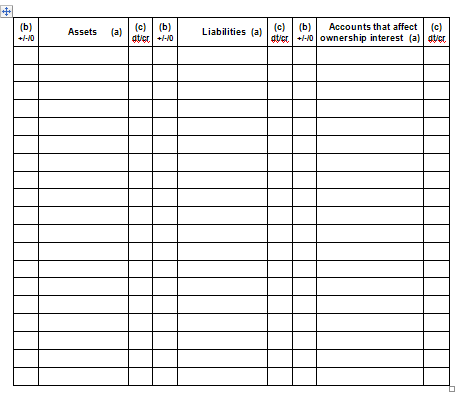

(a) Arrange the accounts in the columns in the table.

(b) Indicate by means of +, - or 0 next to the account whether an increase in it will increase or reduce the ownership interest or leave it unchanged.

(c) Indicate by means of dt. or cr. next to the account whether the account will have a debit or credit opening balance.

table for assignment 2

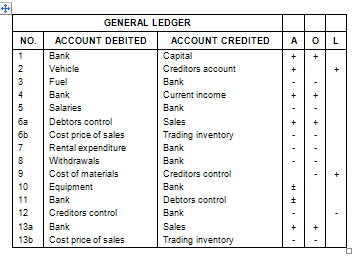

ASSIGNMENT 3:

1 The owner invests R12 000 as capital in the business

2 A vehicle is purchased on credit from TP Motors

3 Fuel is purchased and paid by cheque

4 Cash for service provided is received

5 Salaries are paid by cheque

6 Goods on credit to J. van Schalkwyk are supllied

7 Rent by cheque to A and B Lessors is paid

8 The owner takes cash for his personal use

9 Materials are purchased on credit from AB Suppliers

10 Equipment from Model Suppliers and pays by cheque is purchased

11 Receives the amount owing from J. van Schalkwyk

12 Part of the debt to TP Motors is paid

13 Goods are sold for cash

Table for assignment 3

| GENERAL LEDGER | |||||

| NO. | ACCOUNT DEBITED | ACCOUNT CREDITED | A | O | L |

| 1 | |||||

| 2 | |||||

| 3 | |||||

| 4 | |||||

| 5 | |||||

| 6a | |||||

| 6b | |||||

| 7 | |||||

| 8 | |||||

| 9 | |||||

| 10 | |||||

| 11 | |||||

| 12 | |||||

| 13a | |||||

| 13b | |||||

| Learning Outcomes(LOs) |

| LO 3 |

| MANAGERIAL, Consumer and Financial Knowledge and SkillsThe learner will be able to demonstrate knowledge and the ability to apply responsibly a range of managerial, consumer and financial skills. |

| Assessment Standards(ASs) |

| We know this if the learner : |

| 3.1 completes a basic income statement and balance sheet for a service and retail business; |

| 3.2 investigates the public relations, social responsibility and environmental responsibility strategies and actions of different businesses and organisations; |

| 3.3 completes cash and credit transactions in the books of service and retail businesses; |

| 3.4 uses keyboard skills and function keys in developing, storing, retrieving and editing business documentation; |

| 3.5 analyses financial statements for decision-making at a basic level; |

| 3.6 differentiates between the forms of credit purchases. |

ACTIVITY1

ASSIGNMENT 1

ACTIVITY 1

ASSIGNMENT 2

ACTIVITY1

ASSIGNMENT 3

Notification Switch

Would you like to follow the 'Economic and management sciences grade 9' conversation and receive update notifications?