| << Chapter < Page | Chapter >> Page > |

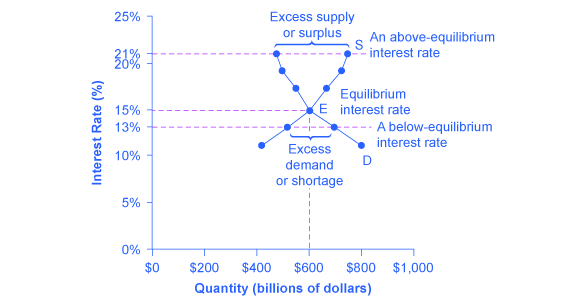

[link] illustrates demand and supply in the financial market for credit cards. The horizontal axis of the financial market shows the quantity of money that is loaned or borrowed in this market. The vertical or price axis shows the rate of return, which in the case of credit card borrowing can be measured with an interest rate. [link] shows the quantity of financial capital that consumers demand at various interest rates and the quantity that credit card firms (often banks) are willing to supply.

| Interest Rate (%) | Quantity of Financial Capital Demanded (Borrowing) ($ billions) | Quantity of Financial Capital Supplied (Lending) ($ billions) |

|---|---|---|

| 11 | $800 | $420 |

| 13 | $700 | $510 |

| 15 | $600 | $600 |

| 17 | $550 | $660 |

| 19 | $500 | $720 |

| 21 | $480 | $750 |

The laws of demand and supply continue to apply in the financial markets. According to the law of demand , a higher rate of return (that is, a higher price) will decrease the quantity demanded. As the interest rate rises, consumers will reduce the quantity that they borrow. According to the law of supply, a higher price increases the quantity supplied. Consequently, as the interest rate paid on credit card borrowing rises, more firms will be eager to issue credit cards and to encourage customers to use them. Conversely, if the interest rate on credit cards falls, the quantity of financial capital supplied in the credit card market will decrease and the quantity demanded will fall.

In the financial market for credit cards shown in [link] , the supply curve (S) and the demand curve (D) cross at the equilibrium point (E). The equilibrium occurs at an interest rate of 15%, where the quantity of funds demanded and the quantity supplied are equal at an equilibrium quantity of $600 billion.

If the interest rate (remember, this measures the “price” in the financial market) is above the equilibrium level, then an excess supply, or a surplus, of financial capital will arise in this market. For example, at an interest rate of 21%, the quantity of funds supplied increases to $750 billion, while the quantity demanded decreases to $480 billion. At this above-equilibrium interest rate, firms are eager to supply loans to credit card borrowers, but relatively few people or businesses wish to borrow. As a result, some credit card firms will lower the interest rates (or other fees) they charge to attract more business. This strategy will push the interest rate down toward the equilibrium level.

Notification Switch

Would you like to follow the 'Macroeconomics' conversation and receive update notifications?